ENID, Okla., January 27, 2009

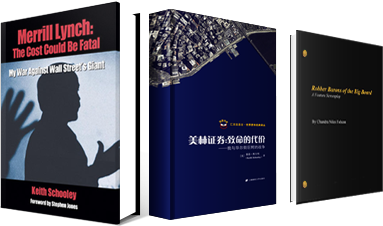

Keith Schooley, author of Merrill Lynch: The Cost Could Be Fatal – My War Against Wall Street’s Giant, says that Bank of America chief Ken Lewis could have benefited from reading his book before committing to purchasing the failed Merrill Lynch.

“Had he done that he would have discovered the inherent duplicity in Merrill Lynch, ranging from brokers to senior management and the board of directors,” says Schooley, who first blew the whistle on corruption and unethical practices at Merrill during the 1990s.

Many in the financial world are now wondering if Merrill’s former CEO, John Thain, may have intentionally duped Lewis in the just-completed transaction, and furthermore misled Merrill’s shareholders regarding the condition of the firm, last year.

Schooley’s landmark book, a harbinger of the ensuing culture of corruption on Wall Street, might have put Lewis on notice that something was terribly wrong at the once mighty Mother Merrill.

When Thain became Merrill Lynch’s CEO near the start of 2008, his first order of business was to hire a celebrity designer to revamp his new suite of offices to the tune of $1.22 million. He also paid a chauffer almost a quarter of a million dollars to whisk him between multimillion dollar residences, during a year that his company was suffering massive losses due to faulty management.

Ironically, Thain had been hired to replace the ousted Stan O’Neal, who had previously led Merrill to ruin. But the losses continued under Thain’s stewardship, forcing sale of the company to BofA in mid-September in order to escape liquidation as investors began to panic.

Thain was forced to resign once it was learned that he had rushed out executives’ year-end bonuses of $4 billion just before the BofA acquisition closed and Lewis’ request for more government bailout money due in part to Merrill’s $15.3 billion fourth quarter loss.

BofA shares began tumbling following the news, and Lewis has come under increased criticism for purchasing the troubled company and using taxpayer dollars to survive his own ill-fated business decision.

“As Americans are suffering job losses due to the meltdown of financial institutions, they are outraged to learn that their tax dollars are being used to continue the lavish lifestyles of Wall Street executives,” says Schooley.

New York Attorney General Andrew Cuomo has begun an investigation into the last minute bonuses arranged by Merrill—reminiscent of the Spitzer investigations that led to hundreds of millions of dollars in fines and the company’s public disgrace during the early part of the decade.

Schooley’s book is indeed a case study of the dismal failure of securities regulators, which seems to have culminated in the Bernard Madoff scandal. As the author writes in his book regarding communications with the SEC, “Soon I would realize just how slumbering the Washington bureaucrats were or, perhaps more likely, how they were influenced by the ‘powerful and mighty.’ ”

Michael L. Rustad, editor of Bimonthly Review of Law Books writes, “Schooley illustrates the ways the ‘powerful and mighty’ play the game inside and outside of a court of law, including employing unethical and perhaps illegal tactics…. He documents a pattern of problems at the firm ranging from brokers to senior management, and suggests that the problems could even be traced to the board of directors…. This is a book that should be read by not only Merrill Lynch clients, but all investors.”

In fact, Merrill Lynch’s former general counsel had predicted more than 15 years ago that the company’s loss of integrity would cost them more than dollars stating: “the cost could be fatal.”

“If the current indigestion in absorbing Merrill Lynch doesn’t bring down the once respected Bank of America then, ultimately, Merrill’s culture of corruption will,” says Schooley.