![]() Oklahoma Gazette

Oklahoma Gazette

May 29, 2003

Court of public opinion

Fired financial superstar exposes questionable practices at Merrill Lynch. He says he is still paying the price and hopes his book will be his vindication.

By Brian Brus

Keith Schooley felt he had found the successful career for which he was destined. The Oklahoma native had just taken a job with one of the largest securities firms on Wall Street and was gaining recognition for turning healthy profits for his clients and the company’s Enid office.

And then he wrote a detailed memo to his managers in New York about problems he saw in the business – potentially illegal or unethical practices – and his life took a dive.

“I was on the fast track at Merrill Lynch. I was a superstar rookie financial consultant….And I turned a blind eye for a while, but it finally got to the point where enough was enough and I had to do something,” Schooley explained.

Schooley was fired. For years afterward, his life was tied up in arbitration, lawsuits taken to the federal Court of Appeals and the state Supreme Court, and appeals to the New York Stock Exchange and the National Association of Securities Dealers. By the end of his ordeal, Schooley had been blackballed from the securities industry and had seen his marriage crumble.

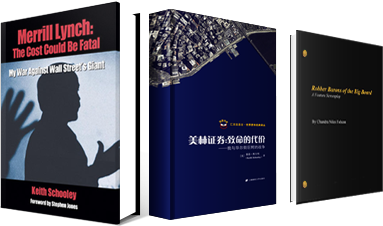

He was left with a book based on his experiences that is now being referenced in college business ethics classes a decade since he took his first steps as an industry whistle-blower: “Merrill Lynch: The Cost Could Be Fatal.”

What I’d like the public to know is what really goes on behind the facade. To this day, Merrill Lynch has escaped any serious consequences,” he told the Oklahoma Gazette. The book, which was published last year, represents his final appeal. “I had to take this case to the court of public opinion…because justice was never achieved.”

Schooley’s original four-page memo to his managers – ironically, “in compliance with Merrill Lynch’s ethical guideline policy,” he said – outlined several questionable issues within the firm, including cheating on insurance exams, the misuse of proprietary mailing lists, the falsification of expense reports and misrepresentations in the company’s competition for new accounts. He said his managers tried to downplay the significance of the practices and ordered him to keep selling.

“That’s when it hit the fan. The New York office came in and instead of getting rid of the bad apples, they tried to cover up,” he said.

The book’s release coincided with other Big Business scandals and bankruptcies in the United States recently, ranging from $4 billion in cash flow accounting fakery at WorldCom Inc. to allegations against Tyco International Ltd.’s chief executive of cheating on sales taxes to Martha Stewart’s insider trading. In an unrelated case, Merrill Lynch last year settled for $100 million with the New York Attorney General’s office on accusations it had misled investors.

Schooley, a life-long Oklahoma resident, still lives in Enid with his two children and is back in the oil business where he started before joining Merrill Lynch. The securities office has since closed and he hasn’t heard from any of his former coworkers, he said.

“Maybe I didn’t win the legal battles, but I won the battle of the truth,” he said. “I believe the truth has value of its own.”